GameStop (GME) shares are extending gains this morning as investors cheer the company’s role in a limited-time Pokémon distribution event.

Starting Sept. 26, GameStop stores in the U.S. are handing out exclusive serial codes for Shiny Miraidon and Shiny Koraidon, legendary Pokémon from the Scarlet and Violet games that are unobtainable in the wild.

Including today’s gains, GameStop stock is up nearly 20% versus its price at the start of September.

Why Is GameStop Stock Rallying on Friday?

GME shares are pushing higher primarily because the event is driving foot traffic and engagement among collectors and competitive players, boosting the firm’s relevance among gamers.

The timing also coincides with launch of the Mega Evolution Pokémon trading card game (TCG) set, adding further momentum to Pokémon-related retail demand.

It’s an exciting showcase of the success that GameStop is achieving with its strategic pivot toward collectibles and trading cards, which now constitute more than 23% of the company’s net sales.

GME’s partnership with PSA for trading authentication services and its forward-thinking move to adopt Bitcoin (BTCUSD) as a treasury reserve asset demonstrate management’s commitment to exploring new growth avenues.

The Pokémon catalyst, especially following Scopely’s $3.5 billion acquisition of Niantic’s gaming division, has provided additional momentum to GameStop shares.

Why Caution Is Warranted in Buying GME Shares

Despite improving sentiment on Friday, several concerning factors warrant caution in buying GME shares.

The GME valuation appears stretched as well, with the forward price-earnings (P/E) ratio pegged at 35x currently, exceeding the sector median.

Plus, the GameStop stock price continues to be heavily influenced by sentiment and momentum rather than fundamental business performance – which may be another red flag for seasoned investors.

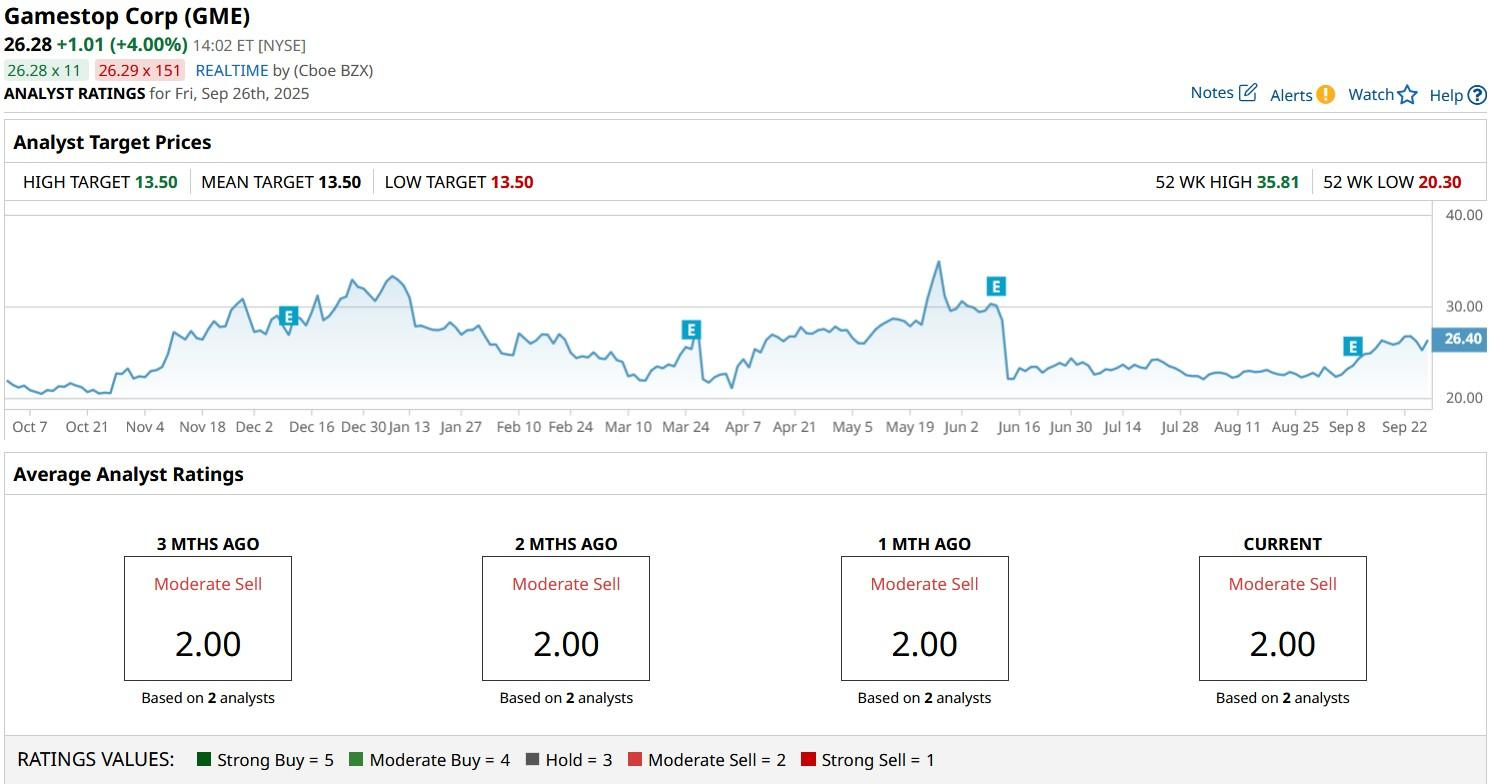

Wall Street Rates GameStop at ‘Moderate Sell’

Investors should also note that Wall Street analysts warn of massive downside in GameStop shares.

According to Barchart, the consensus rating on GME stock currently sits at “Moderate Sell” with the mean target of $13.50 indicating potential downside of more than 45% from here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)